Cost Classification in Management Accounting Pdf

Cost accounting is defined as a systematic set of procedures for recording and reporting measurements of the cost of manufacturing goods and performing services in the aggregate and in detail. Management accounting by Colin Drory.

Cost Classification Defintion Basis Types Of Costs In Accounting

Determining selling price 2.

. In the General Schedule position classification system established under chapter 51 of title 5 United States Code the positions addressed here would be two-grade interval positions. Providing information for decision-making 4. Management accounting is a manufacturing business.

By increasing the number of grades and the weight for life-threatening complications requiring intensive care management. Understanding the Marketing Process. Industries like chemicals textiles food Steel Sugar Shoes Petrol etc.

Objectives of cost accounting There is a relationship among information needs of management cost accounting objectives and techniques and tools used for analysis in cost accounting. Eg 2504 Agency Disbursing Identifier Codeii 8. COST and MANAGEMENT ACCOUNTING.

Use of this data element is exclusive to sub-allocation purposes useful for Financial Reporting. Objectives of Federal Financial Reporting PDF SFFAC 2. The method of calculating the total cost of production by calculating the cost of different processes separately is called process costing.

A Financial Accounting B Management. Marketing Concepts Customer Value and Satisfaction. In what types of industries use the process costing method.

A classification of complications published by one of the authors in 1992 was critically re-evaluated and modified to increase its accuracy and its acceptability in the surgical community. This position classification flysheet establishes the Grants Management Series 1109 and provides the series definition and titling instructions. Accounting involves collection recording classification and presentation of financial data.

To keep systematic records. COST and MANAGEMENT ACCOUNTING. The length of hospital stay was.

V EXECUTIVE PROGRAMME SYLLABUS FOR MODULE 1 - PAPER 2. Financial Accounting vi Objectives and Scope of Accounting Let us go through the main objectives of Accounting. Management accounting by Colin Drory.

Campus Recruitment - Grail Research on 17th Dec. 80 80 found this document useful Mark this document as useful. A description of the managerial.

Customer Value Classification Characteristics Customer. 2 Sub-Allocation formerly known as Limitiii 4. Also there is unanimity in assuming that the behavior of variable costs within a relevant range tends to be linear.

Management accounting by Colin Drory. Accounting is done to keep systematic record of financial transactions. Entity and Display PDF SFFAC 3.

FUNDAMENTALS OF COST ACCOUNTING Study Note 4. Fundamrntals of Cost Accounting 41 Meaning Definition Significance of Cost Accounting its relationship with Financial Accounting Management Accounting 215 42 Classification of Costs 227 43 Format of Cost Sheet 240 Contents. To acquire knowledge and understanding of the concepts techniques and practices of cost and management accounting and to develop skills for decision making.

COST AND MANAGEMENT ACCOUNTING 100 Marks Level of Knowledge. Cost accounting has the following main objectives to serve. Synonymous with Treasury DSSN definitions for each disbursing office eg 1700 Agency Accounting Identifierv 6.

21 Marginal Costing 11. The primary objective of accounting is to help us collect financial. Differentiation among Few Concepts Marketing as an Exchange Process Marketing Management Process Marketing Mix Extended Mix for Services Developing Marketing Orientation.

Save Save COST AND MANAGEMENT ACCOUNTINGpdf For Later. Study Note 2. The consequence of assuming that variable costs vary directly with volume is a classification of cost into fixed and variable.

18 Relationship between Management Accounting and Cost Accounting 7. The word Accounting can be classified into three categories. Handbook by Chapter Accounting Standards and Other Pronouncements As Amended Current Version Cover PDF Contents PDF Foreword PDF Preamble to Statements of Federal Financial Accounting Concepts PDF Statement of Federal Financial Accounting Concepts SFFAC SFFAC 1.

It includes methods for recognizing classifying allocating aggregating and reporting such costs and comparing them with standard costs. Use the Process Costing method.

What Is Cost Classification Definition Basis Of Classification The Investors Book

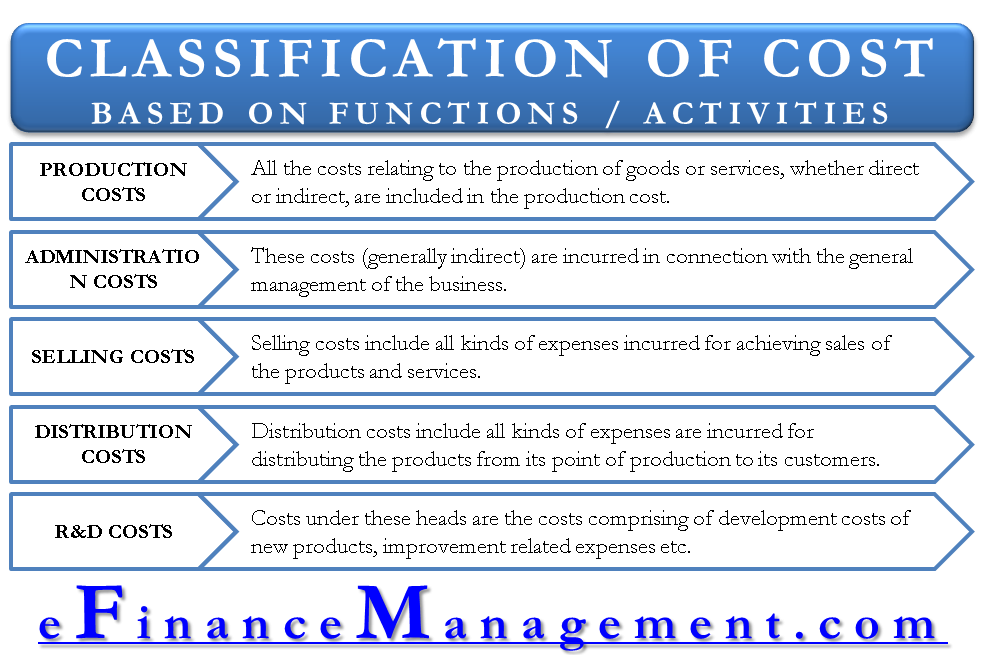

Classification Of Costs Based On Functions Activities Efm

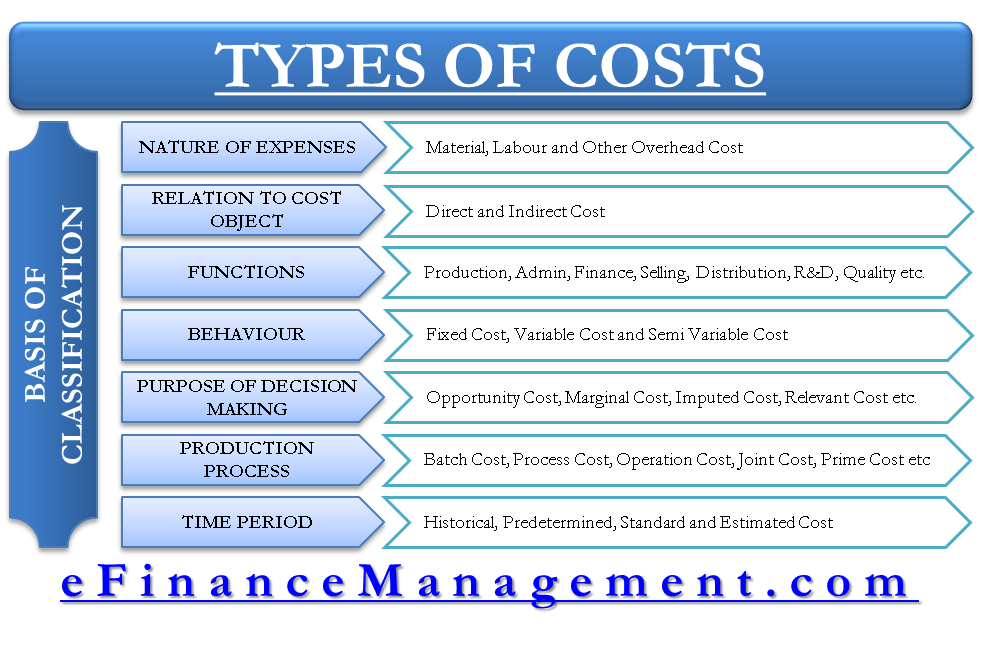

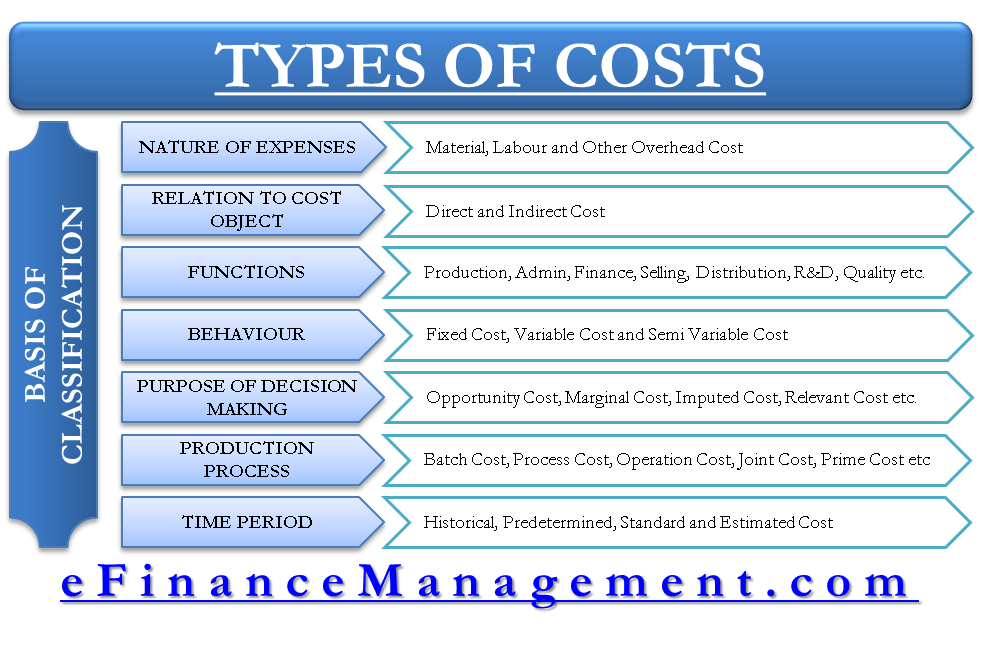

Types And Basis Of Cost Classification Nature Functions Behavior Efm

What Is Classification Of Cost Definition Explanation And Examples

No comments for "Cost Classification in Management Accounting Pdf"

Post a Comment